New and soon-to-be retirees often set lofty retirement goals based on the newfound time and opportunities once they are no longer working. However, some of their most common goals and dreams are never even attempted, let alone achieved.

Goals remain elusive because people often attach misguided thoughts and beliefs to them. Whether they aspire to the following three goals, or completely different ones, they can turn dreams into reality by taking certain steps and then checking them off the list.

Goal 1: Save A Million Dollars

If you randomly approach 10 people and ask how much they need saved for retirement most will blurt out, “I don’t know… maybe a million dollars?” Here’s the real deal: a growing number of people will never have a million dollars saved when they retire. In fact, the likelihood of accumulating one million in a 401(k) or other IRA is very remote. I recently asked Fidelity, a retirement plan leader, how many people had a cool million saved in their retirement plans. It turns out it’s less than 1%.

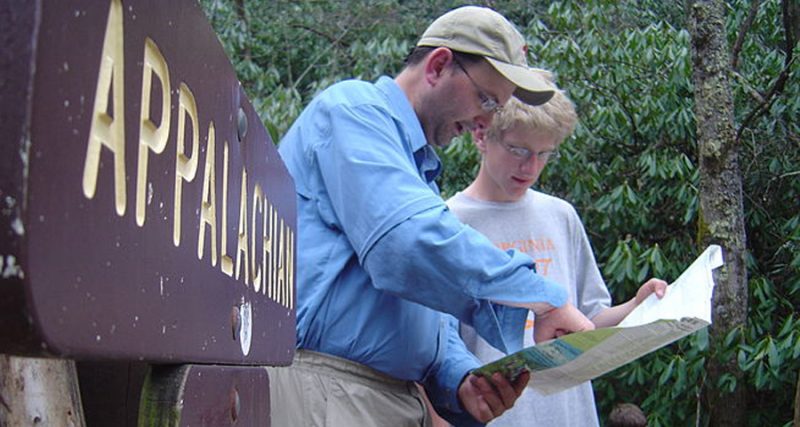

Hiking The Appalachian Trail – Wikipedia

Creating a mindset that you need a million to retire can make retirement feel distant … as if you’ll never get there. Thoughts like this can actually manifest themselves, meaning a lot of investors feel it’s so out-of-reach that they don’t put the time and energy needed to into the savings process. Retirement obstacles and false beliefs can be easily overcome by saving within existing investments and redirecting unused funds toward goals. Strategies may include switching to low cost investments inside your 401(k) (such as Index funds & ETFs); or allocating future bonuses or raises to your savings plan.

Aspiring retirees can make retirement planning as difficult or simple as they wish. They can turn to complex software programs that calculate potential costs of inflation, possible returns under different market scenarios, and even fancy withdrawal rates … or simply estimate how much they need to live on in retirement and multiply it by the number of years they think they’ll be around to enjoy it. Whatever the choice, don’t make it an imaginary number that has no relation to making it there or not. Stop assuming retirement is a time of life where you need enough money saved to sit around and do nothing for 20, 30, or more years. Redefine it in terms of what will make you happy, healthy, and connected… not just dollars and cents.

Goal 2: Write A Book

A common retirement goal is to write a book. Whether it’s a children’s book, cookbook, the next great spy novel, or personal memoirs, there’s a major gap between wanting to write a book and actually doing it. Ernest Hemingway said, “There is nothing to writing. All that you have to do is sit down at a typewriter and bleed.” For some that may be they impression they have as they recall agonizing over school reports and term papers, but the mechanics of writing a book have changed dramatically.

Once again, it starts with mental preparation and removing several myths. First, you don’t have to write a 500 page, hardcover book distributed by a major publishing company. You don’t need a graphic designer, New York city editor, or agent. You need an idea, a computer to type it, and the determination to start.

Removing those obstacles gives future authors more motivation to put pen to paper (or fingers to keyboard), enjoy the creative process, and share thoughts and ideas. Once you have completed a first draft, ask family and friends to proofread it. When it’s ready for printing, find a resource such as InstantPublisher.com. They have book templates for any size document, pre-designed covers, and you can order as few as 25 copies … which can mean you won’t have to dip into savings, or clear out the garage to store a bunch of book inventory.

Many people still prefer a hard copy book to read, but the trend towards more online reading is well underway. That’s good for future authors because it means they don’t have to print copies, keep an inventory, or mail them out. eBooks are available for download on sites such as Amazon.com, Barnes and Noble and more. It can be as simple as converting your book to a pdf and uploading it to the site you select.

Generally speaking, first books are like other things in life, they come with a few mistakes and lessons learned. Yet, with time and practice, a writing style, an ideal audience, and best method to deliver your stories will emerge; although you’ll never get there without that first word, first sentence, and first chapter. So don’t sweat all the stuff that can bog down the process. Let technology and a fresh mindset empower you to get started today.

Goal 3: Hike The Appalachian Trail

If I had a nickel for every new or soon-to-be retiree who expressed an interest in hiking the Appalachian Trail, I would be sipping an umbrella drink in Fiji while dictating this story to my personal assistant. This hiking adventure is a common retirement desire, particularly for men interested in getting back to settler roots; yet, too often it ends up a goal bigger than a pair of hiking boots.

This is a pretty rigorous undertaking but, once again, common misunderstandings and lack of creativity tend to get in the way of execution. The knowledge that this trek can take five to seven months; that trails can be overcrowded; and that feelings of being disconnected from civilization for months at a time are a few of the top concerns that can be overcome with a little out-of-the-box thinking and research.

Most concerns are addressed well by the non-profit Appalachian conservancy, which puts fears regarding time, health, and costs to rest with strategies like flip-flopping the hike… a creative approach to the hike which suggests starting in the middle and working your way back to the start, and then returning later to hike in the opposite direction. It makes the terrain more palatable, reduces crowds and spreads the time.

Of course you still have to do the actual hiking but, as with other goals, removing the mental blocks and obstacles lead to planning and the attempt. And that’s what important; putting your best foot forward in retirement as a means of staying mentally, physically, and financially active.

Retirement doesn’t come with a voucher that says you get 20, 30, or 40 years to do whatever you want, when you want. It can, and often does, change in a moment, making it important to eliminate excuses and maximize the opportunities you have today. The longer you put off striving toward goals, the more distant they seem and the more difficult they are to accomplish. Therefore, put pen to paper today. Whether it’s for a book, a hike, or a new retirement savings approach, start creating your no-regrets retirement plan now.

Leave A Comment